How to Use an SIP Calculator: Step-by-Step Guide for Beginners

sip calculator how to use step by step process here How to Use an SIP Calculator: Step-by-Step Top 5 Guide for Beginners Imagine watching your money grow effortlessly, month after month. Sounds like a dream, right? Well, it’s not! With Systematic Investment Plans (SIPs) and a handy SIP Calculator, you can turn this dream into reality.

Are you tired of complex financial jargon and confusing investment strategies? You’re not alone. Many people struggle to understand how their investments will grow over time. That’s where a SIP calculator comes in handy. It’s your secret weapon for visualizing your financial future and making informed investment decisions. But how exactly do you use one? Don’t worry – we’ve got you covered!

In this step-by-step guide, we’ll walk you through the process of using a SIP calculator. You’ll learn how to understand its components, prepare your financial information, and interpret the results to make smart investment choices. By the end of this post, you’ll be equipped with the knowledge to leverage this powerful tool and take control of your financial destiny. Let’s dive in and unlock the potential of your investments!

Understanding SIP Calculators

What is a SIP calculator?

A SIP (Systematic Investment Plan) calculator is a powerful online tool that helps you estimate the potential returns on your mutual fund investments over time. It takes into account your regular investment amount, expected rate of return, and investment duration to provide you with a projection of your future wealth. How to Use an SIP Calculator: Step-by-Step Top 5 Guide for Beginners

Benefits of using a SIP calculator

(sip calculator how to use step by step process)

Using a SIP calculator offers several advantages for your investment planning:

- Accurateprojections

- Time-saving

- Goal-orientedplanning

- Comparisonof different scenarios

Here’s a breakdown of these benefits:

| Benefit | Description |

| Accurate projections | Provides precise estimates based on your inputs |

| Time-saving | Quickly calculates complex compound interest |

| Goal-oriented planning | Helps you set realistic financial goals |

| Comparison of scenarios | Allows you to compare different investment strategies |

Key components of a SIP calculator

To use a SIP calculator effectively, you need to understand its key components:

- Investmentamount: The regular sum you plan to invest

- Investmentfrequency: How often you’ll invest (monthly, quarterly, )

- Expectedrate of return: The anticipated annual growth rate of your investment

- Investmentduration: The total time period for your investment

By inputting these details, you can get a clear picture of your potential returns. Remember, a SIP calculator is a valuable tool for planning your financial future, but it’s important to use it in conjunction with professional advice for the best results.How to Use an SIP Calculator: Step-by-Step Top 5 Guide for Beginners

Preparing to Use a SIP Calculator

Gathering necessary financial information

Before diving into using a SIP calculator, you’ll need to collect some crucial financial data. This information will help you get accurate results and make informed investment decisions. sip calculator how to use step by step process and Here’s a list of the key details you should have on hand:

Current monthly income

Existing investments and savings

Monthly expenses

Disposable income available for investment

Current age and target retirement age

By gathering this information, you’ll be better prepared to input accurate data into the SIP calculator. This preparation will lead to more reliable results and help you plan your investments more effectively. And here about sip calculator how to use step by step process

Setting investment goals

Once you’ve gathered your financial information, it’s time to define your investment goals. Your objectives will guide your SIP strategy and help you determine the right inputs for the calculator. Consider the following aspects when setting your goals:

| Time Horizon | Goal Examples |

| Short-term | Emergency fund, vacation, down payment |

| Medium-term | Higher education, wedding, home renovation |

| Long-term | Retirement, child’s future, wealth creation |

Remember, your goals should be SMART: Specific, Measurable, Achievable, Relevant, and Time- bound. This approach will help you use the SIP calculator more effectively and tailor your investment strategy to your unique needs.

Determining risk tolerance

Your risk tolerance plays a crucial role in shaping your investment strategy and using the SIP calculator effectively. To assess your risk tolerance, consider these factors:

- Ageand investment horizon

- Financialobligations and responsibilities

- Incomestability

- Overallfinancial health

- Personalcomfort with market fluctuations

- sip calculator how to use step by step proces

Understanding your risk tolerance will help you choose appropriate investment options and set realistic expectations for returns when using the SIP calculator. This knowledge will enable you to make more informed decisions about your investment strategy and better utilize the insights provided by the calculator.sip calculator how to use step by step process.How to Use an SIP Calculator: Step-by-Step Top 5 Guide for Beginners

With these preparations complete, you’re now ready to dive into the step-by-step process of using a SIP calculator. This foundation will ensure you get the most accurate and useful results from your calculations.How to Use an SIP Calculator: Step-by-Step Top 5 Guide for Beginners

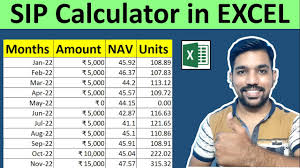

Step-by-Step Guide to Using a SIP Calculator

Accessing a reliable SIP calculator

To begin your investment planning journey, you need to find a trustworthy SIP calculator. Many reputable financial institutions and investment platforms offer free online SIP calculators. Look for one from a well-known source to ensure accuracy. Here’s a quick comparison of popular SIP calculator options: sip calculator how to use step by step process. How to Use an SIP Calculator: Step-by-Step Top 5 Guide for Beginners

| Platform | Features | Ease of Use | Additional Tools |

| Bank websites | Basic calculations | Simple | Limited |

| Mutual fund sites | Detailed projections | Moderate | Fund comparisons |

| Financial apps | Interactive charts | User-friendly | Portfolio tracking |

Inputting monthly investment amount

Once you’ve chosen a calculator, start by entering your planned monthly investment. This is the amount you’re comfortable setting aside regularly for your SIP. Remember, consistency is key in SIP investing. Consider these factors when deciding your investment amount:

Your current income

Monthly expenses

Financial goals

Risk tolerance

sip calculator how to use step by step process

How to Use an SIP Calculator: Step-by-Step Top 5 Guide for Beginners

Selecting investment duration

Next, you’ll need to specify how long you plan to invest. This is crucial as it significantly impacts your potential returns. Longer durations typically yield better results due to the power of compounding. When choosing your investment horizon, think about:

Your age

Financial objectives (e.g., retirement, child’s education)

Expected life changes

Entering expected rate of return

Now, input the anticipated annual return rate. This is usually based on historical performance of similar investments. However, it’s important to be realistic and consider market volatility. Most SIP calculators offer a range of 8-12% as a default. Adjust this based on your chosen investment type and risk appetite.sip calculator how to use step by step process.

Analyzing the results

After entering all the required information, the SIP calculator will generate your projected returns. You’ll typically see:

Total investment amount

Expected returns

Maturity value

Now that you’ve seen the potential outcomes, you can adjust your inputs to align with your financial goals. This iterative process helps you fine-tune your investment strategy for optimal results. sip calculator how to use step by step process

Interpreting SIP Calculator Results

Understanding projected returns

When using a SIP calculator, you’ll encounter projected returns that give you an estimate of your potential investment growth. These projections are based on the inputs you’ve provided, such as investment amount, duration, and expected rate of return. It’s crucial to understand that these figures are estimates and not guaranteed outcomes.sip calculator how to use step by step process

To better grasp projected returns, consider the following table: sip calculator how to use step by step process

| Investment Duration | Monthly SIP Amount | Expected Annual Return | Projected Corpus |

| 10 years | ₹5,000 | 12% | ₹11,61,695 |

| 15 years | ₹5,000 | 12% | ₹24,88,579 |

| 20 years | ₹5,000 | 12% | ₹49,37,800 |

As you can see, the power of compounding becomes evident over longer investment horizons.

Assessing the impact of different variables

SIP calculators allow you to experiment with various variables to see how they affect your investment outcomes. Here are key factors to consider:

- Investmentamount

- Investment duration

- Expectedrate of return

- Frequencyof investments (monthly, quarterly, )

By adjusting these variables, you can gain insights into how different scenarios might play out. For instance, increasing your monthly SIP amount or extending your investment duration can significantly boost your projected returns.

Comparing SIP vs. lump sum investments

SIP calculators often provide a comparison between systematic investment plans and lump sum investments. This comparison helps you understand the benefits of rupee cost averaging that SIPs offer. Consider the following points when comparing: sip calculator how to use step by step process

Risk mitigation: SIPs spread your investments over time, reducing the impact of market volatility.

Flexibility: SIPs allow you to invest smaller amounts regularly, which may be more feasible for many investors.

Compounding benefits: Regular investments through SIPs can potentially yield better returns due to the power of compounding.

By analyzing these comparisons, you can make informed decisions about which investment approach aligns best with your financial goals and risk tolerance. Remember, while SIP calculators are powerful tools, they should be used in conjunction with professional financial advice for optimal results.

sip calculator how to use step by step process

Leveraging SIP Calculator Insights

Adjusting investment strategies

Now that you understand how to interpret SIP calculator results, it’s time to leverage these insights to optimize your investment strategy. Use the calculator to experiment with different scenarios and see how they impact your potential returns:

| Scenario | Monthly Investment | Investment Period | Expected Return | Estimated Corpus |

| Conservative | ₹5,000 | 20 years | 8% | ₹37,19,385 |

| Moderate | ₹7,500 | 20 years | 10% | ₹76,59,530 |

| Aggressive | ₹10,000 | 20 years | 12% | ₹1,39,07,973 |

By comparing these scenarios, you can adjust your investment strategy to align with your risk tolerance and financial goals.

Setting realistic financial goals

With the insights gained from the SIP calculator, you can set more realistic and achievable financial goals. Consider the following steps:

- Identifyyour long-term objectives (e.g., retirement, child’s education)

- Usethe calculator to determine the required monthly investment

- Assessif the required amount fits your current budget

- Ifnot, adjust your goals or timeline accordingly

- Regularlyreview and update your goals as your financial situation changes

Planning for long-term wealth creation

The SIP calculator is an invaluable tool for planning your long-term wealth creation strategy. Here’s how you can use it effectively:

Start early: Use the calculator to see how starting your SIP earlier can significantly boost your returns

Increase investments gradually: Plan to increase your monthly SIP amount annually in line with your salary increments

Diversify: Use the calculator to plan investments across different asset classes and schemes

Stay committed: The calculator shows the power of compounding over time, encouraging you to stay invested for the long haul

- sip calculator how to use step by step process

By leveraging these insights from the SIP calculator, you’ll be better equipped to make informed investment decisions and work towards your financial goals with confidence.

sip calculator how to use step by step process

Using a SIP calculator is a powerful way to plan your financial future and make informed investment decisions. By following the step-by-step process outlined in this guide, you can easily input your investment details, calculate potential returns, and gain valuable insights into your long-term financial goals. Remember, a SIP calculator is not just a tool for number crunching; it’s a gateway to understanding the potential of your investments and making strategic decisions.sip calculator how to use step by step process

As you embark on your investment journey, make the SIP calculator your trusted companion. Use it regularly to review and adjust your investment strategy, explore different scenarios, and stay on track towards your financial objectives. sip calculator how to use step by step processBy harnessing the power of compounding and systematic investing, you’re taking a significant step towards securing your financial future. Start using a SIP calculator today and watch your investments grow with confidence and clarity.sip calculator how to use step by step process

FAQ for SIP Calculator

1. What is an SIP calculator?

An SIP (Systematic Investment Plan) calculator is a tool that helps you estimate how much wealth you can create by investing a fixed amount every month for a specific duration, along with the expected returns.

2. Is an SIP calculator free to use?

Yes, most SIP calculators available online are free and user-friendly. They’re designed to make your financial planning easier without costing a dime.

3. Do I need to be good at math to use an SIP calculator?

Absolutely not! If you can type numbers and click a button, you’re good to go. The calculator does all the math for you.

4. What details do I need to use an SIP calculator?

You’ll typically need to input:

- The amount you want to invest monthly

- The investment duration (in years or months)

- The expected annual rate of return

5. Can an SIP calculator guarantee returns?

No, the calculator provides an estimate based on the expected rate of return. Actual returns depend on market conditions and the performance of your investments.

6. How is the maturity amount calculated?

The calculator uses the formula for compound interest:

FV = P × [(1 + r/n)^(nt) – 1] × (1 + r/n)

Where:

- FV = Future Value (maturity amount)

- P = Monthly investment

- r = Expected annual return (in decimal)

- n = Number of compounding periods per year (usually 12 for monthly SIPs)

- t = Time in years

7. Can I calculate for different scenarios?

Yes! You can adjust the monthly amount, duration, or expected returns to see how they impact the maturity amount.

8. Why do I need an SIP calculator?

It simplifies your financial planning, helps you set realistic goals, and shows how small investments over time can lead to significant wealth creation.

9. Is the SIP calculator suitable for all investments?

The SIP calculator is ideal for mutual funds or other investments that follow a systematic, monthly contribution model. For other types of investments, specialized calculators might be better.

10. Where can I find an SIP calculator?

You can find SIP calculators on most mutual fund company websites, financial planning platforms, and investment apps.

1 thought on “How to Use an SIP Calculator: Step-by-Step No !Guide for Beginners”