Top 10 Most Common Financial Mistakes

1. Not Having a Budget

Top 10 Most Common Financial Mistakes: Many people struggle with managing their finances and because they don’t have a clear budget. Without a budget, it’s easy to overspend and lose track of where your money is going.

Example: Sarah earns $50,000 a year but doesn’t track her expenses. She finds herself running out of money before the end of the month and wonders why. If she had a budget, she could plan her spending and save more effectively.

Example:

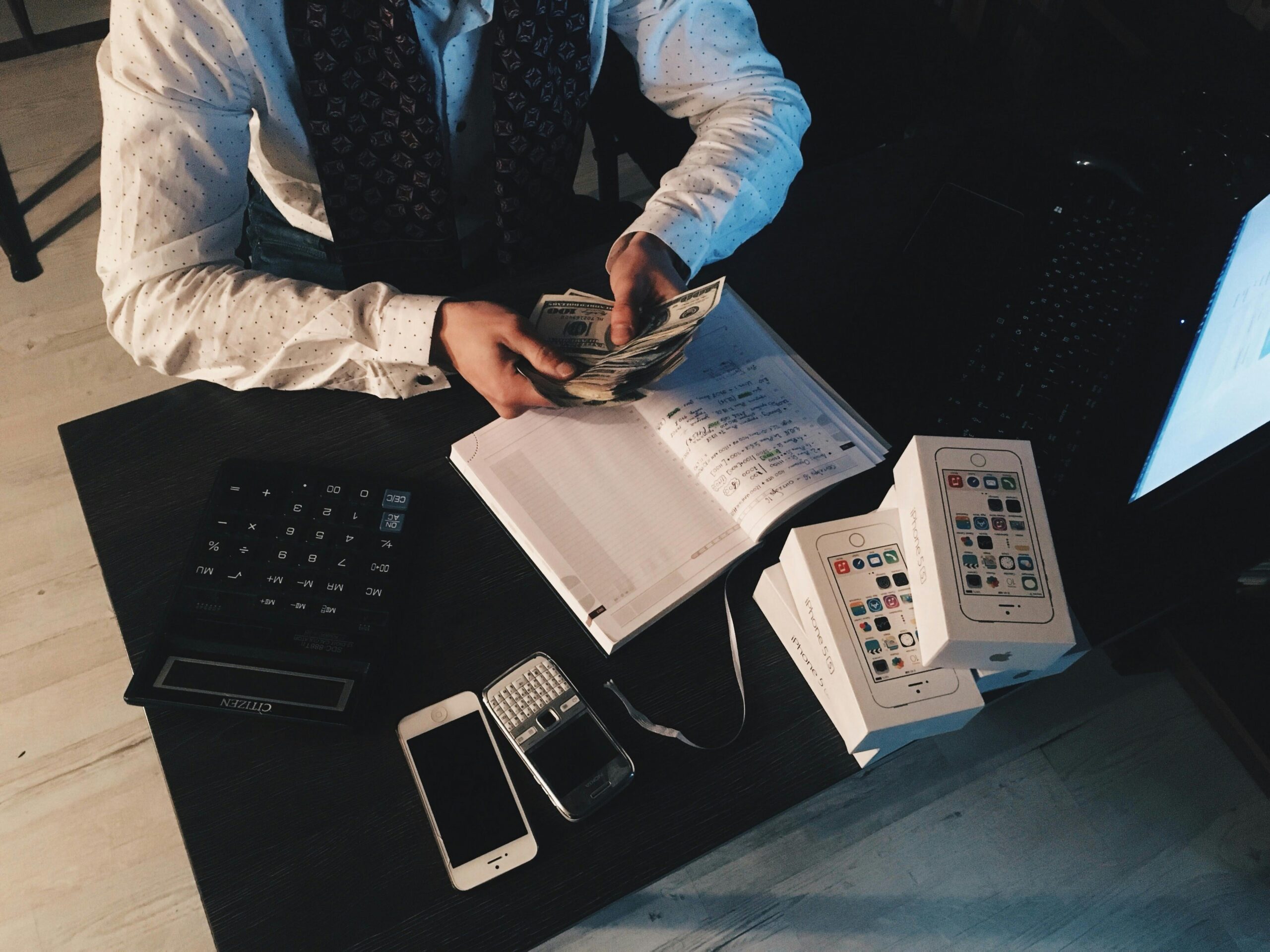

Ravi, a 28-year-old IT professional, earns ₹50,000 per month. Instead of living within his means, he rents a luxury apartment for ₹25,000, buys the latest smartphone on EMI, and frequently dines at expensive restaurants. To cover his lifestyle, he uses his credit card excessively, accumulating ₹2 lakh in debt.

One day, his company faces financial issues and delays salary payments. Without savings and with high credit card bills, Ravi struggles to pay rent and meet daily expenses. He is forced to take a high-interest personal loan, which further worsens his financial situation.

If Ravi had followed a budget and avoided unnecessary expenses, he could have saved money, built an emergency fund, and avoided financial stress. Top10 Most Common Financial Mistakes.

Comparison: A Saver vs. A Non-Saver

Example Scenario: Ravi (Non-Saver) vs. Arjun (Saver)

Both Ravi and Arjun are 28-year-old IT professionals earning ₹50,000 per month. However, their financial habits are entirely different.

Ravi (Non-Saver) – Living Beyond His Means

- Rents a luxury apartment for ₹25,000.

- Buys a ₹1.5 lakh smartphone on EMI.

- Spends ₹15,000 per month on dining out, entertainment, and shopping.

- Uses credit cards excessively and has ₹2 lakh in outstanding debt.

- Has no emergency fund or savings.

- Impact: When his company delays salary payments, Ravi struggles to pay rent, EMIs, and credit card bills. He takes a high-interest personal loan, which worsens his financial situation.

- Top10 Most Common Financial Mistakes.

Arjun (Saver) – Financially Disciplined

- Rents a modest apartment for ₹12,000.

- Uses his old smartphone and saves for a new one instead of taking EMI.

- Allocates ₹8,000 for entertainment but controls impulse purchases.

- Saves ₹15,000 per month and invests ₹5,000 in mutual funds.

- Builds an emergency fund with 6 months’ worth of expenses.

- Impact: When his company delays salary payments, Arjun remains stress-free. His emergency fund covers expenses, and his investments continue to grow.

Top 10 Most Common Financial Mistakes

Key Takeaways:

- Ravi (Non-Saver) ends up in debt, stressed, and financially unstable.

- Arjun (Saver) is financially secure, independent, and prepared for uncertainties.

This comparison clearly shows the importance of saving and financial discipline. Do you want a similar comparison for any other financial mistake?

2. Living Beyond Your Means

Spending more than you earn can lead to financial disaster. Using credit cards for unnecessary purchases can pile up debt quickly.

Example: John buys a brand-new car on a loan even though he can’t afford the monthly payments comfortably. This leads to financial strain and debt accumulation.

3. Not Saving for Emergencies

Unexpected expenses can arise at any time. Without an emergency fund, you may need to rely on loans or credit cards, leading to further debt. Top10 Most Common Financial Mistakes.

Example: Lisa’s car breaks down, and she has no savings. She uses her credit card, accumulating high-interest debt she struggles to repay. Top10 Most Common Financial Mistakes.

4. Ignoring Retirement Savings

Many people postpone saving for retirement, thinking they have plenty of time. However, the earlier you start, the more you benefit from compound interest.

Example: Mike starts saving for retirement at 25, contributing $200 monthly. His friend, Alex, starts at 40. By retirement, Mike has significantly more savings.

5. Not Investing Wisely

Keeping all your money in a savings account may not yield high returns. Investing helps grow your wealth over time.

Example: Emily keeps her savings in a low-interest account while her friend James invests in stocks and bonds, seeing much higher returns over time.

6. Paying Only the Minimum on Credit Cards

Paying only the minimum amount keeps you in debt longer and results in paying excessive interest.

Example: Tom owes $5,000 on his credit card and pays only the minimum. It will take him years to pay off the debt while accumulating thousands in interest. Top10 Most Common Financial Mistakes.

7. Not Having Insurance

Many people overlook health, home, and life insurance, leading to financial hardship in emergencies.

Example: Steve doesn’t have health insurance. After an accident, he faces enormous medical bills, depleting his savings.

8. Making Emotional Financial Decisions

Impulsive buying and investing based on emotions rather than logic can lead to financial loss.

Example: After hearing stock market rumors, Jane invests without research. The stock crashes, and she loses her money.

9. Not Seeking Professional Financial Advice

A financial planner can help you make informed decisions, especially for investments and tax planning.

Example: Mark handles his investments without knowledge. A financial advisor could have helped him choose better options.

10. Ignoring Debt Repayment

Delaying debt payments increases interest and affects credit scores.

Top10 Most Common Financial Mistakes.

Example: Rachel ignores her student loan payments. Over time, her debt increases due to interest and late fees.

30 FAQs with Clear Explanations

1. Why is budgeting important? A budget helps track income and expenses, preventing overspending and enabling savings.

2. How can I create a simple budget? List your income, categorize expenses, and allocate funds accordingly.

3. What percentage of my income should go to savings? Financial experts recommend saving at least 20% of your income.

4. How can I reduce unnecessary expenses? Identify non-essential spending and cut back on luxury items.

5. What is an emergency fund? Savings set aside for unexpected expenses like medical bills or car repairs.

6. How much should I save for emergencies? Aim for 3-6 months’ worth of living expenses.

7. When should I start saving for retirement? As early as possible to maximize compound interest benefits.

8. What are the best investment options for beginners? Consider mutual funds, index funds, and retirement accounts.

9. How can I get out of credit card debt faster? Pay more than the minimum and prioritize high-interest debts first.

10. Why should I avoid living beyond my means? Spending more than you earn leads to debt and financial instability.

11. How do I improve my credit score? Pay bills on time, reduce debt, and avoid multiple credit inquiries.

12. What’s the impact of late debt payments? Late payments incur fees, increase interest, and harm credit scores.

13. How does compound interest work? Earnings from investments generate additional earnings over time.

14. Why is having insurance important? Insurance protects against financial loss in emergencies.

15. Should I buy or rent a house? It depends on financial stability and long-term goals.

16. How can I avoid making emotional financial decisions? Research before investing and avoid impulse purchases.

17. What’s the best way to track expenses? Use budgeting apps or maintain a spreadsheet.

18. Should I consolidate my loans? It can simplify payments and reduce interest, but review the terms first.

19. How can I increase my income? Consider side hustles, freelancing, or career advancements.

20. What is a good debt-to-income ratio? Ideally, less than 36% of your income should go toward debt payments.

21. Why should I seek financial advice? Experts provide strategies for better financial decisions.

22. How can I start investing with little money? Begin with small contributions in mutual funds or ETFs.

23. What’s the difference between good and bad debt? Good debt (like mortgages) builds wealth, while bad debt (like credit card debt) drains finances. Top10 Most Common Financial Mistakes.

24. How does inflation affect my savings? Inflation reduces purchasing power, so invest wisely to outpace it. Top10 Most Common Financial Mistakes.

25. Should I have multiple income streams? Yes, diversifying income protects against financial downturns.

26. How can I teach kids about money management? Start with allowances, saving habits, and financial discussions.

27. What’s the 50/30/20 budgeting rule? 50% for needs, 30% for wants, and 20% for savings and investments.

28. How can I prepare for financial emergencies? Build an emergency fund and have insurance coverage.

29. Why should I avoid payday loans? They have high-interest rates that trap borrowers in debt cycles.

30. How do I stay motivated to save money? Set clear goals, track progress, and reward small achievements.

1. What are the most common financial mistakes people make?

Many people struggle with overspending, failing to save, accumulating debt, not investing, and neglecting insurance. These mistakes can lead to financial insecurity in the long run. Top10 Most Common Financial Mistakes.

2. How does living beyond your means impact financial health?

Living beyond your means often results in debt accumulation, stress, and an inability to save for emergencies or retirement. It can trap you in a paycheck-to-paycheck cycle. Top10 Most Common Financial Mistakes.

3. Why is not having an emergency fund a big mistake?

Without an emergency fund, unexpected expenses—like medical bills or car repairs—can force you into high-interest debt. Experts recommend saving at least 3–6 months’ worth of expenses.

4. What are the risks of relying too much on credit cards?

Excessive credit card use can lead to high-interest debt, damaging your credit score and making future borrowing more expensive.

5. How does not having a budget hurt your finances?

Without a budget, it’s easy to overspend, miss savings opportunities, and lose track of financial goals. A budget helps you control expenses and prioritize savings. Top10 Most Common Financial Mistakes.

6. Why is impulse buying dangerous for financial stability?

Impulse purchases can quickly add up, leading to unnecessary expenses that prevent you from saving for important financial goals.

7. How does neglecting retirement savings affect your future?

Delaying retirement savings means missing out on compound interest, which can significantly reduce your wealth when you retire.

8. What is the impact of ignoring investments?

Without investing, your money loses value due to inflation. Investments grow your wealth over time and help secure your financial future.

9. Why is not tracking expenses a problem?

Failing to track expenses can lead to financial leaks where money is wasted on unnecessary things, making it harder to save or invest.

10. What happens if you don’t have health insurance?

A sudden medical emergency can result in massive bills, depleting your savings or pushing you into debt.

11. Why is taking out unnecessary loans a bad idea?

Unnecessary loans mean paying interest on things you don’t truly need, reducing your ability to save and invest.

12. How can avoiding financial planning hurt you?

Without financial planning, it’s easy to make poor decisions, miss opportunities, and fail to prepare for future needs.

13. Why is ignoring tax planning a mistake?

Poor tax planning can lead to higher tax liabilities, missed deductions, and penalties, reducing your take-home income.

14. How does failing to build credit affect your future?

A poor credit score can make it difficult to get loans, mortgages, or even rent an apartment at favorable rates.

15. What happens if you lend money without expecting repayment?

Lending large sums without a repayment plan can damage relationships and put you in financial distress. Top10 Most Common Financial Mistakes.

16. Why is lifestyle inflation a financial risk?

As income increases, many people increase spending instead of saving, which prevents long-term financial growth.

17. How does not having a financial goal affect your money management?

Without clear goals, it’s easy to waste money instead of saving for meaningful purchases like a house or retirement.

18. Why is relying only on a single income source risky?

Job loss or economic downturns can leave you without income, so having multiple income streams helps with stability.

19. What are the dangers of co-signing a loan?

If the borrower defaults, you are legally responsible for repaying the loan, which can damage your finances.

20. How can emotional spending harm your finances?

Spending to relieve stress or sadness can lead to unnecessary purchases, putting you into financial trouble.

21. Why is not negotiating salary a financial mistake?

Failing to negotiate can mean earning thousands less over your lifetime, affecting your long-term wealth.

22. How does procrastinating on debt repayment affect you?

Delaying debt payments leads to accumulating interest and penalties, making it harder to become debt-free.

23. What is the consequence of not reviewing financial statements?

You may miss fraudulent transactions, unnecessary fees, or overspending trends that could be corrected.

24. Why is underestimating the cost of major life events dangerous?

Marriage, having children, or buying a home come with hidden costs that can strain finances if unprepared.

25. How does failing to invest in self-education impact finances?

Without improving skills and knowledge, you may miss better job opportunities or investment strategies.

26. What happens if you don’t prepare for inflation?

Rising costs mean your savings lose value over time, so investing wisely is crucial to maintain purchasing power.

27. How does ignoring debt-to-income ratio affect loan approval?

Banks check this ratio before approving loans. A high ratio signals risk and can lead to loan rejection.

28. Why is not having a will a financial mistake?

Without a will, your assets may not be distributed as you intended, and legal battles could cost your heirs.

29. How does failing to take advantage of employer benefits hurt you?

Many people overlook retirement contributions, insurance, and stock options provided by employers, missing out on financial perks.

30. Why is ignoring passive income opportunities a bad decision?

Relying only on active income limits wealth potential. Passive income, such as rental properties or dividends, can provide financial freedom. Top10 Most Common Financial Mistakes.

These FAQs provide clear explanations of common financial mistakes and how to avoid them. Let me know if you need any modifications! Top10 Most Common Financial Mistakes.

Top10 Most Common Financial Mistakes.

2 thoughts on “Financial Mistakes Top10 Most Common..”