What if I Invest 1000 Rs in SIP for 20 Years?

What if I Invest 1000 Rs in SIP for 20 Years? : Investing is an essential part of financial planning, especially for young jobbers who are just starting their careers. Systematic Investment Plans (SIPs) are an excellent way to invest small amounts regularly and grow wealth over time. In this article, we will explore what happens if you invest 1000 Rs in a SIP for 20 years, how it can benefit young jobbers, and what kind of returns you can expect.

What is SIP and How Does it Work?

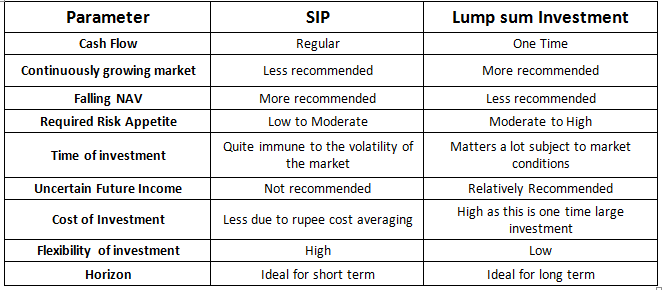

A Systematic Investment Plan (SIP) is a disciplined approach to investing in mutual funds. Instead of making a lump sum investment, you contribute a fixed amount at regular intervals, usually monthly. The money is invested in mutual funds, which can be equity, debt, or hybrid, depending on your risk appetite. Over time, the power of compounding and rupee cost averaging helps maximize returns.

For young jobbers, SIP is a great way to start investing early with small contributions. It helps in wealth creation without putting a financial burden on their monthly expenses.

plan rich and be rich by Investing 1000 Rs in SIP for 20 Years.

The Power of Compounding in SIP

Compounding is the process where the returns earned on your investments are reinvested to generate additional returns. This cycle continues, creating a snowball effect that leads to exponential growth over time. Investing early allows young jobbers to take full advantage of compounding, even with small amounts like 1000 Rs per month.

For example, if you invest 1000 Rs every month in a SIP that provides an average annual return of 12%, after 20 years, your total investment will be 2,40,000 Rs. However, due to compounding, the total corpus will be around 10-12 lakhs, depending on market fluctuations.

Expected Returns from 1000 Rs SIP for 20 Years

When investing in mutual funds through SIP, returns are subject to market performance. However, historical data suggests that equity mutual funds deliver an average return of 10-15% per annum over the long term. Here’s an estimate based on different return rates:

- 8% Return: ~6 Lakhs

- 10% Return: ~7.5 Lakhs

- 12% Return: ~10 Lakhs

- 15% Return: ~14 Lakhs

Young jobbers should keep in mind that patience is key, and the longer they stay invested, the more benefits they reap.

Why SIP is the Best Option for Young Jobbers?

1. Low Investment Requirement

SIPs allow young jobbers to start investing with as little as 500 Rs per month. With a 1000 Rs SIP, they can steadily build wealth without affecting their daily expenses.

2. Disciplined Investing

Since SIPs are automated, they encourage discipline. Money is deducted directly from your bank account, ensuring regular investments.

3. Rupee Cost Averaging

Market fluctuations don’t affect SIP investments significantly, as you purchase more units when prices are low and fewer when prices are high, balancing out the cost.

4. Long-Term Wealth Creation

A 1000 Rs SIP for 20 years can turn into a substantial corpus, helping young jobbers achieve financial stability, fund higher education, or buy a home.

How to Choose the Best SIP for 20 Years?

For young jobbers, selecting the right SIP is crucial for maximizing returns. Here’s what to consider:

- Fund Performance – Check historical returns of mutual funds over 5-10 years.

- Expense Ratio – Lower expense ratios mean higher take-home returns.

- Risk Appetite – Equity SIPs have higher risk but better returns; debt SIPs are safer with lower returns.

- Investment Goals – Choose funds aligned with your long-term financial goals.

Risks Involved in SIP Investments

While SIPs offer good returns, they are not risk-free. Here are some risks to consider:

- Market Volatility – Equity funds fluctuate based on market conditions.

- Inflation Impact – If returns do not outpace inflation, your real purchasing power decreases.

- Fund Underperformance – Not all mutual funds perform well; choosing the wrong one can lower your returns.

However, young jobbers should not worry too much about short-term market fluctuations. Staying invested for the long term helps mitigate most risks.

How to Start a SIP Investment?

Starting a SIP is simple. Here’s a step-by-step guide for young jobbers:

- Choose a Mutual Fund Platform – Zerodha, Groww, Paytm Money, or your bank’s investment portal.

- Complete KYC – Provide PAN, Aadhaar, and bank details.

- Select the Mutual Fund – Based on risk and return preferences.

- Set Monthly SIP Amount – Start with 1000 Rs and increase later if possible.

- Enable Auto-Debit – Automate SIP payments for hassle-free investing.

- Monitor and Review – Check your investment performance periodically.

What if I Invest 1000 Rs in SIP for 20 Years?

Yes! Most SIP platforms allow you to increase your monthly contribution over time. This feature, called Step-Up SIP, helps young jobbers gradually invest more as their income grows. For example:

- Start with 1000 Rs/month

- Increase by 10% annually

- After 20 years, the corpus will be significantly larger compared to a fixed 1000 Rs SIP.

SIP Tax Benefits for Young Jobbers

Investing in Equity Linked Savings Scheme (ELSS) through SIP offers tax benefits under Section 80C of the Income Tax Act. You can claim deductions up to 1.5 lakhs per year. This makes ELSS SIPs an attractive option for young jobbers looking to save taxes while investing.

Conclusion

Investing 1000 Rs in a SIP for 20 years is a smart financial decision for young jobbers. It helps in wealth creation, offers tax benefits, and secures financial stability in the long run. The key to maximizing returns is starting early, staying consistent, and choosing the right mutual funds. With patience and discipline, a small monthly investment can turn into a significant corpus over time.

FAQs

- Is 1000 Rs SIP enough for young jobbers?

Yes, it’s a great start! You can always increase the amount as your income grows. - Which is the best SIP for 20 years?

Equity mutual funds like large-cap, mid-cap, and ELSS are good options for long-term investments. - Can I withdraw my SIP before 20 years?

Yes, SIPs are flexible, but withdrawing early may impact compounding benefits. - Are SIPs safe for young jobbers?

SIPs in equity funds have market risks, but long-term investing reduces volatility impact. - How much will 1000 Rs SIP grow in 20 years?

Depending on returns (10-15%), the corpus can be anywhere between 7-14 lakhs.

FAQ:

next i need on SWP